×

Let’s imagine a world where launching a traffic partnership feels less like a negotiation marathon and more like opening a perfectly designed app. You log in. You see profiles.

On one side — media buyers with preferred payment models, traffic sources, average volumes, and tolerance for testing.

On the other hand, programs with clear KPIs, visible starting caps, transparent terms, approval speed, retention metrics, and, most importantly, zero “surprise clauses” hidden three scrolls below.

In this imaginary app, you swipe right on transparent revshare terms, high CPA rate, clear traffic guidelines, and responsive account managers. You swipe left on vague payout conditions, shifting KPIs, frozen payments, and “we’ll review quality later” energy.

Sounds convenient, right?

In reality, partnerships don’t come with built-in filters. They come with spreadsheets, negotiation threads, trial periods, and a fair share of red flags. And both sides — affiliates and media buyers — are screening each other just as carefully.

In this article, we’ll break down what truly matters at the start of collaboration: what earns trust, what triggers caution, and what instantly turns a promising deal into a polite “we’ll get back to you.”

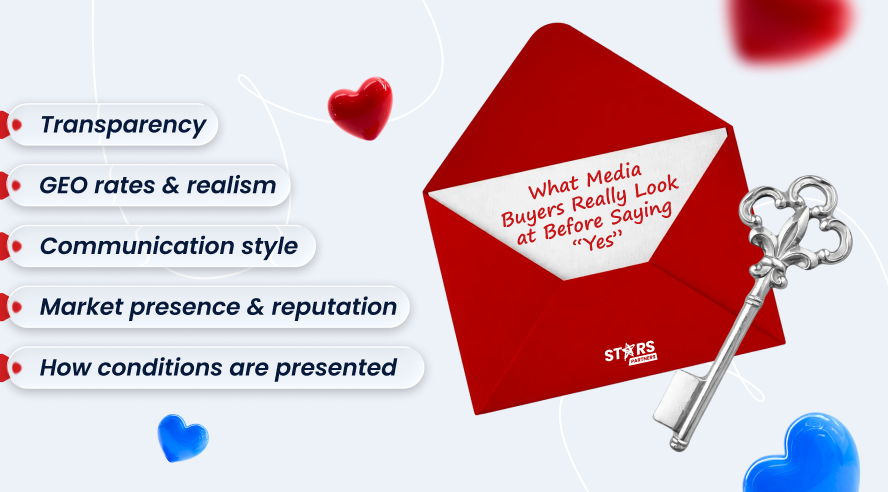

If media buyers had a superpower, it would be pattern recognition. They’ve seen shiny decks, “best offer ever” promises, and KPIs that looked great — until they didn’t. So when a new affiliate reaches out, they don’t just listen. They evaluate.

Here's what actually goes through a media buyer's head:

1. Communication style

Is the affiliate clear and structured? Or is it all hype and zero specifics? Media buyers value partners who speak in metrics, not emotions.

2. How conditions are presented

Are starting caps, KPIs, validation rules, and payment terms explained upfront? Or do details appear gradually like plot twists?

3. GEO rates & realism

Do the CPA and RevShare terms align with market benchmarks? If the numbers look "too generous," that's not excitement — that's suspicion.

4. Market presence & reputation

How long has the company been active? Are there public reviews, case studies, and industry visibility?

5. Transparency

Clear tracking, defined fraud rules, and understandable traffic requirements.

Because for media buyers, trust starts where ambiguity ends.

Affiliates don't fall for "we buy a lot of traffic" anymore. Volume without quality is just expensive noise. So when a media-buying team arrives with confidence and bold projections, affiliates quietly open their internal checklist.

Here's what they're actually evaluating:

1. Time on the market

Are you new and experimenting — or battle-tested? Experience matters, especially when KPIs tighten.

2. Speed of data sharing

How fast can you provide stats? Clean screenshots. Slow reporting = slow trust.

3. GEO focus

Which markets do you actively run? More importantly, do you operate in our GEOs?

4. Real expertise in those GEOs

Have you optimized funnels there before? Do you understand local traffic behavior?

5. Traffic quality signals

Retention, deposit patterns, fraud levels. Not just clicks and registrations.

Because affiliates don't just look for spenders, they look for partners who understand how to turn traffic into sustainable performance — not temporary spikes.

In theory, every partnership starts with optimism. In practice, both sides are scanning for early warning signs — and once a red flag appears, it's very hard to unsee it.

1. Payments are inconsistent.

If payouts arrive "almost on time" or require constant reminders, that's not a delay — that's a pattern.

2. Frequent payment freezes or excuses.

"Finance is reviewing." "Next week for sure." Media buyers track cash flow as rigorously as they track ROI. Instability kills scale.

3. No clear feedback on traffic quality.

If traffic is labeled "low quality" without metrics, examples, or breakdowns, it feels like a blame game, not optimization.

4. Reputation noise in the market.

Too many negative reviews, unresolved complaints, and public disputes. Where there's smoke, there's usually on fire.

1. "Just send volume" with no KPIs.

Scaling without clear targets is not ambition. It's risk transfer.

2. Refusal to share statistics.

No funnel data, no transparency? That's not strategy — that's opacity.

3. Creative secrecy after negative feedback.

If something goes wrong and the media buyer won't share the creatives used, trust erodes instantly.

Because in this industry, transparency isn't a bonus feature. It's the baseline.

Partners build strong collaborations by aligning KPIs, defining clear terms, and taking mutual responsibility. When both sides value transparency and performance, scaling stops feeling risky and starts feeling predictable.

And if you'd rather work with a team that treats collaboration as strategy — not improvisation — partnering with Stars Partners might be your smartest swipe right.